Shipping to the EU post Brexit

We are still shipping to the EU!

As of the 1st of January 2021, the UK is no longer part of the EU. For our UK customers there will be no changes, but please let us know if you require any commodity code information. For our EU customers, we have outlined below exactly what this means when you place an order with us.

The great news is that there are not any major changes, and we have been able to continue a successful working relationship with all of our EU customers. Please don't hesitate to get in touch if you require any further information.

What are the main changes?

VAT/Tax

Tax is paid on imports into the EU from the UK to the government of the country where the goods are being imported. E.g. goods from the UK to Germany will incur tax of 19% of the order value.

We will now be able to apply the relevant VAT/Tax to your order so that it is paid directly through our website. We then pay this on your behalf.

If you are Tax registered, you will be able to claim back the VAT/Tax that you have paid in your country as you currently do on other items.

Customs Duty

Customs duty is different to VAT/Tax, and is the duty paid on imported goods based upon their commodity code classification, which in turn is based on the makeup of the item themselves.

EORI number

If you have a VAT number in your country, you will need an EORI number in order to accept the delivery and to claim back the Tax on the order. We cannot create a field for this on the website, so please email this through to us if you haven’t already.

If you do not have one, you will need to contact your government to get one.

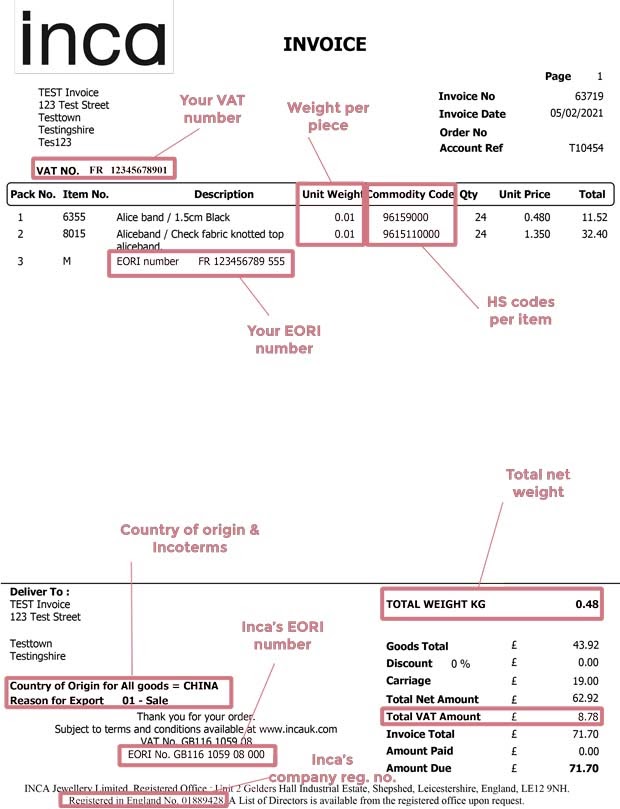

Your invoice

Your invoice will have the following important details on it allowing easy declarations at the border with our couriers or with your shippers.

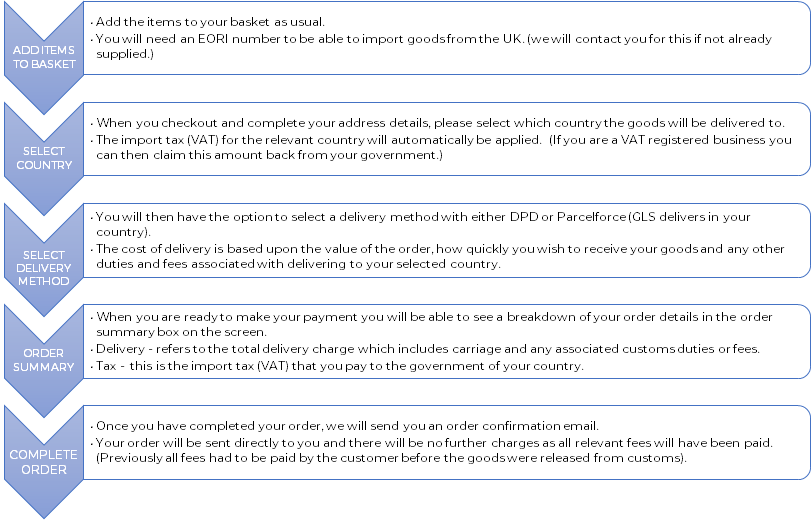

What happens when you order?

We have updated our systems so that all of the associated costs (VAT, customs duty, fees, delivery) with your order are automatically applied online once you select the country we are shipping to. This means that you will have total visibility of all of the costs that you are required to pay for imports into your country. We have changed how the taxes and duties are charged, to mean your parcel is not stopped to collect the charges from you, the customer.

What are the different costs?

There are 3 different costs to import goods from the UK - VAT, customs duty, and delivery.

1) Tax/VAT

VAT is the tax paid to the government of the country where the goods are being imported.

- As we are a UK based supplier, when you place an order with us and import goods into your country there may be VAT to pay to your own government. The amount of VAT varies for each country.

- We will now be able to apply the relevant VAT to your order so that it is paid directly through our website.

- If you are a VAT registered business, you will be able to claim back the VAT that you have paid in your country as you currently do on other items.

2) Customs Duty

Customs duty tax is different to VAT, and is the tax paid on imported goods based upon their commodity code classification.

Any import duty is included in the delivery charges and is based on the country we are shipping to. We have chosen to subsidise this to share the cost and reduce the charges for you, the customer.

3) Delivery

Our delivery costs to the EU include carriage, customs duty and courier handling fees relevant to the country we are shipping to. We have subsidised the duty and border charges allowing you to carry on trading with us. The cost of delivery is based on the value of the goods being shipped and the speed at which you wish to receive your order. You will be able to select which courier you would like to deliver your parcel and can see the costs listed for each country above. Please note that each cost is broken down by order value (before any discount is applied).